Our Services

Assisted Bookkeeping

Bookkeeping Services

Thank you for your interest in bookkeeping with PlumbBooks! If you are interested in general bookkeeping services, please fill out our client application to get started. We will get back to you shortly to let you know if you are a good fit and schedule an initial consultation.

Reporting Services

Know MORE from your numbers! We help clients get answers to important questions, like:

- What’s my gross profit margin?

- What percentage of my revenue am I spending on direct labor?

- How much do I bring in per truck each day or on average each month?

- What’s my Working Capital or how much money do I have minus what I owe?

- Am I making progress toward my revenue goals?

- And so MUCH MORE!

Consulting & Virtual CFO

Need someone to review your integrations, do a check-in on your QuickBooks, help with budgeting, or give you a high level view of what’s going on with your money? Book a consultation today to get expert support from our team!

Diagnostic Reviews & Cleanups

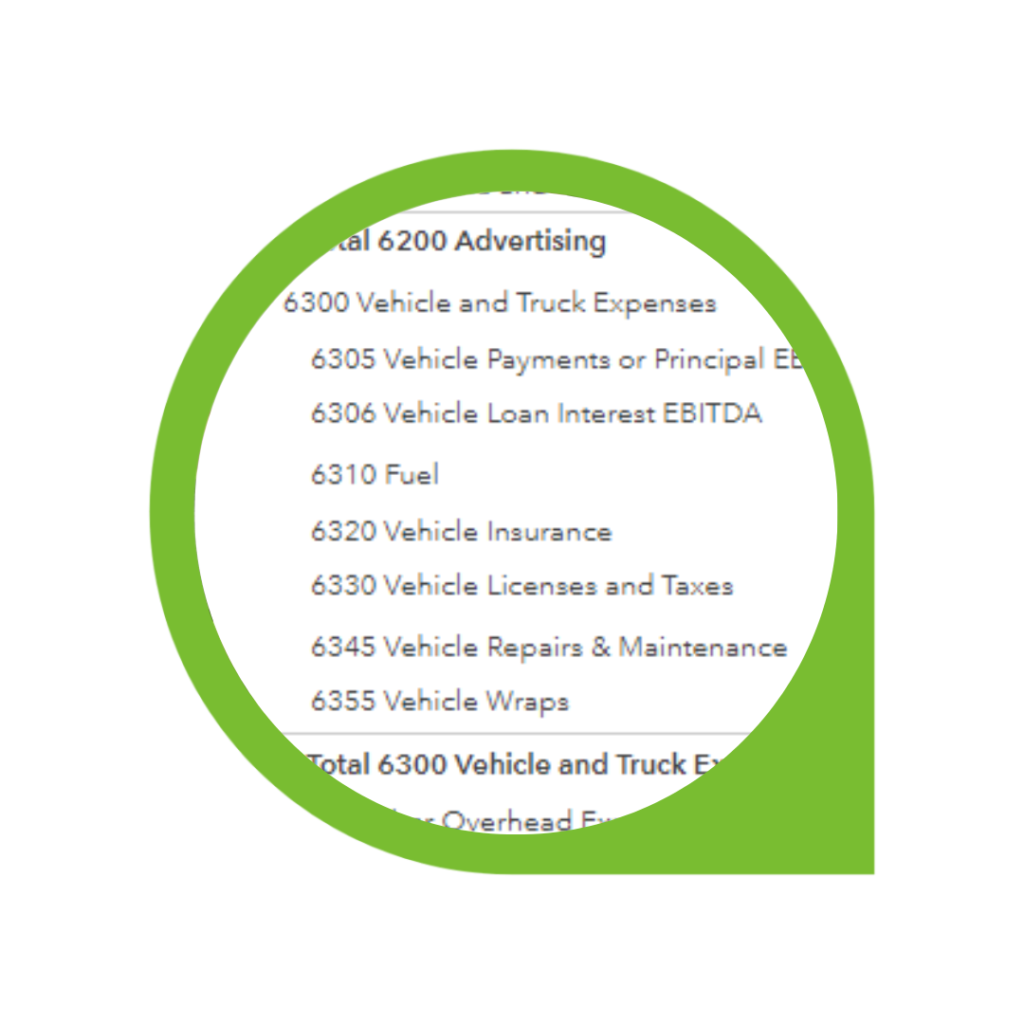

Free Chart of Accounts!

Would you like to use the same chart of accounts we use here at PlumbBooks? This is meant for shops running 6 or fewer trucks who do not keep inventory on their books. It is a great place to start, and can be modified to suit your needs.